Join Rick’s journey through the banking industry’s changes, and his commitment to local decision-making.

We’re Bruce and Karen Carlson. We recently moved to the Metro East area of Illinois. It’s a whole new world out there. Our goal with this website is to share our exploration of the Metro East area. As we find businesses and services we use in our daily lives, we’ll share how these businesses and services have helped make our lives better and easier to live.

We’re calling our move to the Metro East area retirement, but we’re not quite sure what that means. By sharing our story with you, we hope you too will gain a better sense of what the Metro East area has to offer and how their businesses and services can improve your lives and build a better community.

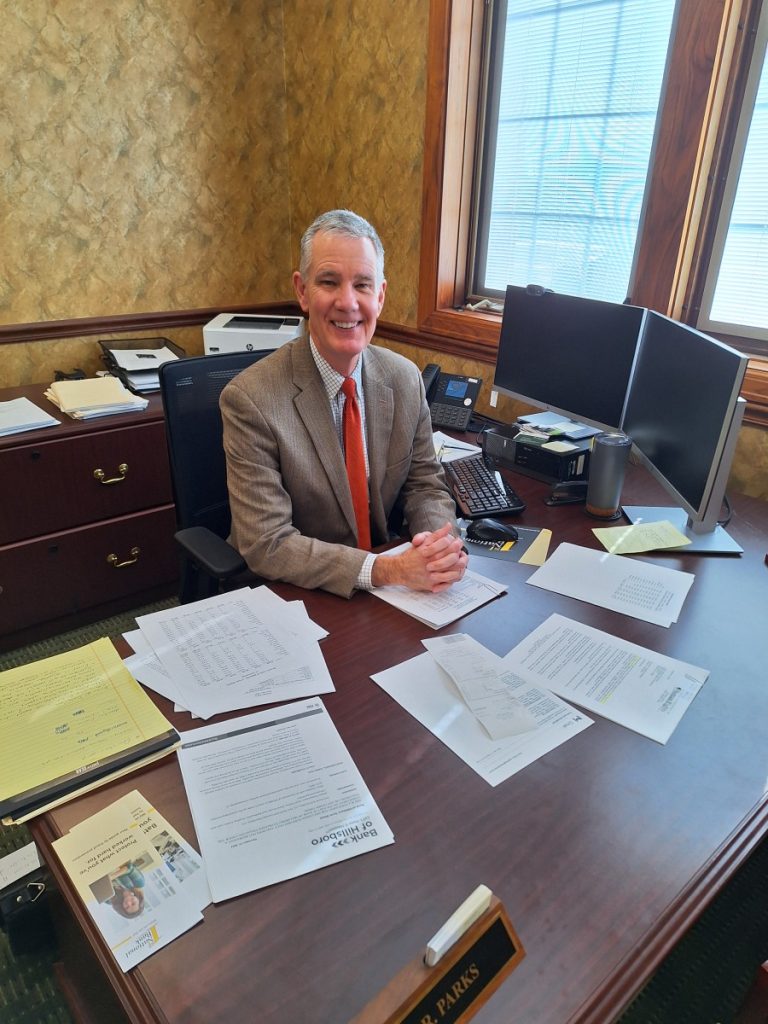

An interview with Rick Parks, President and CEO of 1st National Bank of Waterloo

Today I traveled over to Waterloo for a visit to the 1st National Bank of Waterloo and met with Rick Park, President and CEO of the bank. It was a bit of a flashback to when Karen and I lived in Blue Green, IA. As I walked into the bank I could feel the same sense of friendly community welcome.

The bank lobby had people in it. A woman came up and asked if she could help me. It was a flashback to the bank in Blue Grass. There was that welcome and come on in and have a seat feeling. How’s things going what can we do for you? Karen does most of the banking so I don’t go into the bank often, but when I have I remember a sterile feeling.

As I sat down with Rick in his office, it felt like we had known each other for years and had just started chatting about what was happening. It wasn’t so much an interview with Rick about the bank as it was two friends catching up on the latest news. So, let me share our conversation and experience the friendly charm you’ll receive at the 1st National Bank of Waterloo.

Bruce:

Tell us about your background and journey to president of the 1st National Bank of Waterloo.

Rick:

Rick’s journey in the banking world is both impressive and extensive, spanning an incredible 36 years. His experience covers a broad spectrum, having worked with both smaller banks and large, multi-billion-dollar regional banks. Throughout his career, he’s witnessed firsthand the inner workings of different types of banking institutions, which has shaped his perspective and preference for community banking.

He passionately explained why he favors the community bank model over larger national or regional banks. For Rick, it’s about agility and local decision-making. Community banks, he finds, can respond more quickly and effectively to the needs of their customers because they don’t have the bureaucratic layers that larger banks often do.

Rick’s enthusiasm for community banks isn’t just professional; it’s deeply personal. He shared a poignant story about his parents, who were farmers in west central Illinois, struggling during the economic hardships of the late 70s and early 80s. Interest rates were sky-high, and the agriculture economy, particularly the hog market, was in dire straits.

Many farmers in his area were facing ruin. His parents, too, were on the brink, dealing with a large national agricultural lender. In their hour of need, they turned to a local community bank. This bank, familiar with his parents and their situation, chose to invest in them despite the challenging economic climate.

This act of faith and support from a community bank helped his parents not only save their farm but also eventually pay off their mortgage. This personal experience left a profound impact on Rick, solidifying his belief in the power and importance of community banking.

Rick’s career predominantly involved commercial lending, which eventually led him to the First National Bank of Waterloo. This bank, with a legacy dating back to 1912 and celebrating its 112th anniversary, was seeking a new leader. Rick, with his deep roots and extensive experience in the Metro East area’s banking scene, was an ideal candidate.

After a thorough interview process, he was chosen to lead the bank. Now, four years into his role as president and CEO, Rick expresses a genuine love for his work.

He speaks highly of his team and the bank’s role in the community, emphasizing their strong commitment to customer care and local investment. For Rick, leading the First National Bank of Waterloo is not just a job; it’s a continuation of a lifelong commitment to the principles of community banking that he holds so dear.

Bruce:

About the banking philosophy, how does 1st National Bank of Waterloo differentiate itself from other banks in terms of services and customer relationships?

Rick:

Rick passionately explained the core principles that set the 1st National Bank of Waterloo apart from other banks. He emphasizes three main areas where they excel: customer care, employee welfare, and community service. He starts by highlighting their exceptional customer care.

According to Rick, while most banks claim to prioritize customer service, 1st National Bank of Waterloo genuinely lives up to this promise. This commitment is evident in the way they empower their branch managers and lenders to make key decisions. Whether it’s about handling overdrafts, reversing charges, or making loan exceptions, the bank trusts its employees to make the right call. This empowerment, Rick believes, leads to superior service and customer satisfaction.

The bank’s approach to customer service is twofold: first, they focus on the quality of service. Rick points out that money might be the same color in every bank, but the level of service can vastly differ. He takes pride in the bank’s ability to guide customers through their financial journey with a high degree of knowledge and skill. Secondly, they pay great attention to customer feedback, consistently receiving praise for their exceptional care.

Turning to employee care, Rick shares that the bank not only offers generous benefits but also fosters a team-oriented culture. He often reminds the staff of 175 employees about the importance of kindness and respect, regardless of any differences. This philosophy helps avoid departmental silos and promotes a collaborative working environment.

Lastly, Rick speaks about the bank’s commitment to community service, which goes beyond mere financial transactions. They actively participate in local events, from chicken dinners to parades, making sure they’re at the forefront of community involvement.

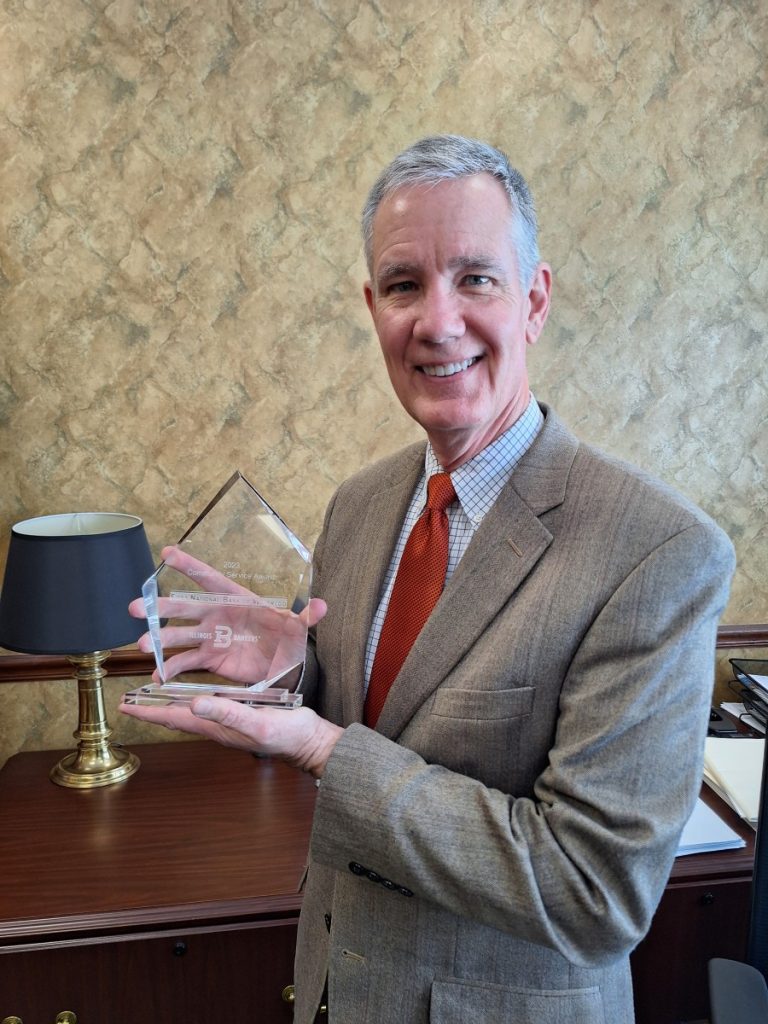

This dedication was recognized by the Illinois Bankers Association in 2023, which awarded them for their outstanding community service. Unlike some banks that focus on a single project, First National Bank of Waterloo was commended for its consistent and widespread engagement in various projects throughout the year.

Rick emphasizes that even though they are known as the 1st National Bank of Waterloo, their reach and service extend to all 14 communities where they have branches. He views this award as a testament to the bank’s hard work and dedication to building stronger communities.

Bruce:

The next question is what innovations in banking do you find most exciting, and how is the banking incorporating these into their operation? What new things are coming up?

Rick:

Rick candidly shares his thoughts on the innovations in the banking industry, particularly from the perspective of a smaller bank like 1st National Bank of Waterloo. He acknowledges that they aren’t at the forefront of cutting-edge technology like some of the larger banks, which have more resources to invest in the latest innovations.

He gives an example of a technology that some larger banks have adopted but the 1st National Bank of Waterloo has chosen to avoid: Interactive Teller Machines (ITMs). These machines replace the traditional in-person teller with a screen and a remote teller, potentially located states away.

Rick explains that this model, despite its efficiency on paper, doesn’t align with their philosophy. They value the personal touch and believe in maintaining human interactions in their banking services.

He emphasizes the importance of having live tellers and bankers who can sit down with customers, guide them through processes like securing a construction loan, and provide a first-class, in-person experience.

However, Rick is excited about the technological advancements that align with their mission to serve customers ‘no matter how they bank.’ He highlights the increasing use of mobile banking, where customers can perform various banking tasks like depositing checks, checking balances, and transferring money right from their phones.

1st National Bank of Waterloo is actively investing in this area to cater to the needs of all their customers. Rick points out that their clientele is diverse: some prefer the in-person banking experience and avoid technology, while others may have never visited a branch in person, relying entirely on online services. Most fall somewhere in between. The bank’s goal is to be relevant and accessible to all these customer types.

Rick also touches on the broader trend of consolidation in the banking industry. He notes that the number of bank charters has dramatically decreased over the past 30 years, from around 15,000 to less than 5,000. This consolidation is largely due to mergers and acquisitions. 1st National Bank of Waterloo itself has made two acquisitions in the past four years.

Rick explains that for smaller banks, it’s becoming increasingly challenging to operate independently due to the growing compliance demands and operational overheads. Many of these smaller banks, often family-run for generations, are finding partnerships with slightly larger banks like 1st National Bank of Waterloo a viable option to continue their legacy.”

Bruce:

Community engagement, you mentioned the parades and things like that. What else can you add to that?

Rick:

Rick spoke with genuine passion about community engagement, reflecting his personal beliefs and leadership philosophy. He embraces the adage that community service is the rent we pay for the space we occupy on this earth, and he lives this philosophy through his actions. Rick doesn’t just lead by directing; he leads by doing. He’s not one to boast, but he shares that he actively serves on seven not-for-profit boards, demonstrating his commitment to community involvement.

He gives several examples of how he participates in community service initiatives. For instance, Rick mentioned a recent blood drive organized by the bank, where he donated blood. He believes such acts are essential ways of giving back to the community. When there are parades, Rick is often there, walking alongside others if he’s available.

Another initiative he highlights is the ‘Heat Up St. Louis‘ event, a collaboration between Hardee’s restaurants and Ameren to help those struggling to pay their heating bills. In this program, Hardee’s offers a discounted sausage biscuit for a dollar, and all proceeds go towards this cause. Rick himself volunteers in this event, standing in the drive-up lanes early in the morning, even on the coldest days of the year, to collect donations.

This is just a glimpse of the various ways Rick and the 1st National Bank of Waterloo contribute to the community. Whether it’s participating in local events, supporting charitable causes, or leading by example in community service, Rick’s commitment to building and strengthening his community is clear. He’s dedicated not only to his role in the bank but also to making a tangible difference in the lives of those around him.”

Bruce:

Talk about economic outlooks and challenges. How do you see the current economic climate affecting local businesses and customers in Waterloo?

Rick:

Rick offers a comprehensive view of the current economic climate and its impact on local businesses and customers in Waterloo, reflecting on the challenges and opportunities ahead. He begins by acknowledging the significant economic upheaval caused by covid-19 and the resulting government interventions.

The US Treasury injected approximately 6 trillion dollars in stimulus money into various sectors, including individuals, businesses, and municipalities. This response was crucial during a time when unemployment soared to nearly 15%. Rick notes that the Federal Reserve’s two main mandates, ensuring full employment and stable prices, were particularly tested during this period.

The unemployment rate, after peaking during the pandemic, has now dropped to historic lows, hovering around 3.7%. This reduction in unemployment is a positive sign, but Rick points out that the focus has shifted to combating high inflation. He acknowledges the Federal Reserve’s efforts in raising interest rates to slow down economic growth, noting that inflation has peaked but is still a concern.

Rick observes that overall, businesses are doing well, particularly in the manufacturing and service industries, including healthcare, hospitality, and accounting. He mentions the labor shortage as a primary challenge, especially in manufacturing, where the situation has been exacerbated by previous supply chain issues. In the housing market, low inventory remains an issue, partly due to people being locked into low interest rates and unwilling to move to higher rates.

However, Rick expresses concern over the rising credit card debt in the country, which has surpassed a trillion dollars. He notes an uptick in delinquencies in credit card and auto loans, indicating financial stress among some consumers. The resumption of student loan repayments, which had been on hold, adds another layer of financial burden for many.

Looking ahead to 2024, Rick remains cautiously optimistic. While there’s been talk of a recession, he believes that if one occurs, it’s unlikely to be deep or prolonged. This optimism is based on several factors: the strength of the labor market, fixed long-term debts like home loans, and the substantial amount of cash on personal and business balance sheets that went unspent during the pandemic.

Rick concludes that these factors, coupled with continued consumer spending and strong demand in tourism and travel, bode well for the economy, despite potential recessionary effects.”

Bruce:

You mentioned house buying. We came down and bought a house and we had one of those 3% loans that we gave up, but we came down here and our interest rate is twice as much. At first, it was concerning until we remembered some of our early homes had 9%, so 6%, wasn’t so bad.

Rick:

Rick acknowledges the tendency to forget historical trends in interest rates, noting that the recent low rates were not typical over the long term. He mentions that while rates have risen, reaching about 8% for 30-year loans, they have started to decrease. This change might present an opportunity for refinancing in the near future.

Bruce:

Customer experience and digital banking. Now, like I said, I’m still sort of the old-fashioned guy. I don’t necessarily need to have everything on cell phones, but I know that’s where we’re going. You mentioned a little bit about that. Is there anything you need to expand on or talk about there?

Rick:

Rick elaborates on 1st National Bank of Waterloo’s approach to customer experience and digital banking, emphasizing their goal to stay relevant and adaptive to changing times. He acknowledges that while the bank may not be on the cutting edge of technology, they aim to be ‘fast followers’ – adopting innovations promptly after they’ve been proven effective. This approach allows them to balance technological advancement with their core values.

A key aspect of their strategy is relying on external vendors for technology solutions. This approach works well for a bank of their size, as it allows them to invest in necessary technology without compromising their agility or the quality of their personal service. Rick believes this positions the bank in an ideal ‘sweet spot’ for their market, enabling them to offer both modern banking solutions and the personal touch that distinguishes them from larger banks.

Rick touches on the bank’s business philosophy, particularly in commercial banking. He advises business owners to choose a bank that matches their scale. For small to medium-sized businesses in their community, 1st National Bank of Waterloo is well-suited, as they focus on serving this segment rather than engaging in large, metropolitan banking projects. This focused approach ensures that their customers don’t feel lost in the shuffle of a larger institution.

The personal touch is a significant part of their customer experience. Rick takes pride in the fact that when customers call their bank, they are greeted by a live person, not an automated menu. This human element is something he knows many of their customers, especially those from older generations, greatly appreciate.

However, he also notes that there’s a generational shift occurring, with some younger customers initially surprised to be speaking directly to a person rather than navigating a phone menu.

This balance of modern digital banking solutions with a strong emphasis on personal, human interactions is at the heart of 1st National Bank of Waterloo’s customer service philosophy. Rick believes that by maintaining this balance, the bank can cater effectively to a diverse range of customer preferences and needs.

Bruce:

The future. What do you see?

Rick:

Rick reflects on the recent growth of 1St National Bank of Waterloo and shares his vision for the bank’s future. He begins by presenting a striking picture of the bank’s growth over the last decade, using total assets as a key metric. Ten years ago, the bank’s assets ranged between 300 to 400 million dollars. Today, it has nearly doubled, reaching 940 million dollars. This remarkable growth, according to Rick, is the result of a combination of strategic acquisitions and the influx of stimulus money.

The bank’s expansion strategy involved acquiring two banks – one in Collinsville with two branches, and another in St. Labory with three branches, including New Athens. These acquisitions played a significant role in the bank’s growth. Additionally, the several trillion dollars of stimulus money distributed by the Treasury contributed to an increase in bank deposits, further boosting banking growth.

Rick also credits the dedicated efforts of their bankers in generating new business through persistent outreach. He clarifies that the goal was never simply to double in size within a set timeframe, but rather to seize appropriate growth opportunities. The successful integration of the two acquired banks is a point of pride for Rick.

He emphasizes that customers of the acquired banks continue to receive the same, if not better, level of service, with the added benefit of improved technology and additional product offerings. Importantly, the same familiar faces continue to serve them at their local branches, maintaining a sense of continuity.

Looking ahead, Rick is optimistic about the future. He believes that providing excellent service and products at fair prices naturally leads to growth. The bank plans to continue expanding organically at a modest pace while remaining open to potential acquisition opportunities.

However, Rick insists that any growth must align with the bank’s culture and be beneficial overall – a philosophy of ‘one plus one equals three.’ He envisions potential partnerships with well-run banks that excel in their markets but are looking for an exit strategy, where a merger with 1st National Bank of Waterloo could be mutually beneficial.

Rick’s outlook for the bank is grounded in a commitment to maintaining their culture and values while exploring opportunities for sensible and strategic growth.”

Bruce:

Very good. I guess from more of a personal point of view, not so much from the questions that I have asked, and you touched on it a little bit, the idea of the smaller banks condensing into this consolidation. For me, that’s a little bit of a concern because I don’t like the idea of everything falling into one or two big areas. Do you see that continuing or is that something that’s going to shake out here?

Rick:

Rick addresses the concern about the consolidation trend in the banking industry with a blend of realism and hope. He acknowledges that the trajectory of consolidation, from 15,000 to less than 5,000 bank franchises in the U.S., is likely to continue.

When compared to other developed countries, the U.S. still has a significantly higher number of banks. Rick doesn’t deny the possibility of a banking system functioning well with fewer banks, even as few as 500, but he expresses a clear preference for maintaining a larger number of smaller community banks. He believes that these banks serve a unique niche that larger national and super-regional banks might not fill as effectively.

Rick reflects on the history of 1st National Bank of Waterloo to illustrate the challenges and opportunities for growth. Starting as a single-branch bank 40 years ago, they have expanded into multiple communities, such as Columbia, Millstadt, and others.

With each new branch, the challenge was to maintain the ‘hometown bank’ feel where employees and customers are known personally. While growth makes this more difficult, Rick emphasizes that it’s not impossible, just that it requires more intentionality and effort to preserve that close-knit, community-focused culture.

Looking to the future, Rick predicts that while the number of bank charters will likely continue to decrease, there will still be thousands for quite some time. He’s confident that there will always be a place for smaller community banks.

He stresses that not all banks are looking to sell or merge; many have succession plans in place to continue serving their communities independently. Rick believes that even with fewer community banks, they will continue to play a vital role in the banking landscape, meeting the needs of their local communities in ways that larger institutions may not.

His vision is one of cautious optimism. While acknowledging the trend towards consolidation, he holds onto the belief that community banks like 1st National Bank of Waterloo will remain an essential part of the banking industry, serving their communities with a personal touch and deep local understanding.

Wrap up

Our journey into the Metro East area continues to reveal the warmth and friendliness of this area. It was a great pleasure to sit with Rick and learn how the 1st National Bank of Waterloo is helping people in the community achieve their goals and dreams. Karen and I have found a wonderful location to retire to. We look forward to continuing our journey and learning about life in our new home.

We hope you are enjoying these articles and are willing to continue to follow along as we share our adventures of learning about life in southern Illinois, This is an exciting area and we are so happy to be part of this area. Our lives are being fulfilled by the people we are meeting. Bruce & Karen.

This website is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program designed to provide a means for sites to earn advertising fees by advertising and linking to Amazon.com and affiliated sites. As an Amazon Associate, I earn from qualifying purchases.

Enjoy the pictures

We’re Bruce and Karen Carlson. We recently moved to the Metro East area of Illinois. This area is east of St. Louis from the Mississippi River north to Alton, east to Carlyle, back south to Waterloo and the Mississippi River, finally north to Columbia. The center is Fairview Heights, Swansea, Belleville, Shiloh, and O'Fallon. Not to be forgotten is Southern Illinois University (SIU) in Edwardsville. It’s a whole new world out there. Our goal with this website is to share our exploration of the Metro East area. As we find businesses and services we use in our daily lives, we’ll share how these businesses and services have helped make our lives better and easier to live.

We’re calling our move to the Metro East area retirement, but we’re not quite sure what that means. By sharing our story with you, we hope you too will gain a better sense of what the Metro East area has to offer and how their businesses and services can improve your lives and build a better community.